Naturally, intelligent traders expect to trade reliably. Buying during the support period and selling during the resistance period is the formula here. Ranging and trending both are effective based on choices. Range trading is the best approaches to take in Forex. In some cases, one comes forward, and in some cases, it is the other. But since we are discussing range, we will not distract you from that. Ranging reduces uncertainty. It increases the chance of winning more than others. Let’s discuss the types.

Table of Contents

Rectangular range

When you enter in rectangular ranges, you see a horizontal movement of price between support and resistance. This is extremely common in most of the situation. Even if you do not use an indicator, you can quickly identify its horizontal movement and scale your trades based on the market conditions.

Pros: it indicates that the timeframe is short, which encourages speedy trade opportunities.

Cons: sometimes misleading things can happen to traders who do not stay in the market for a more extended period of patterns.

Diagonal range

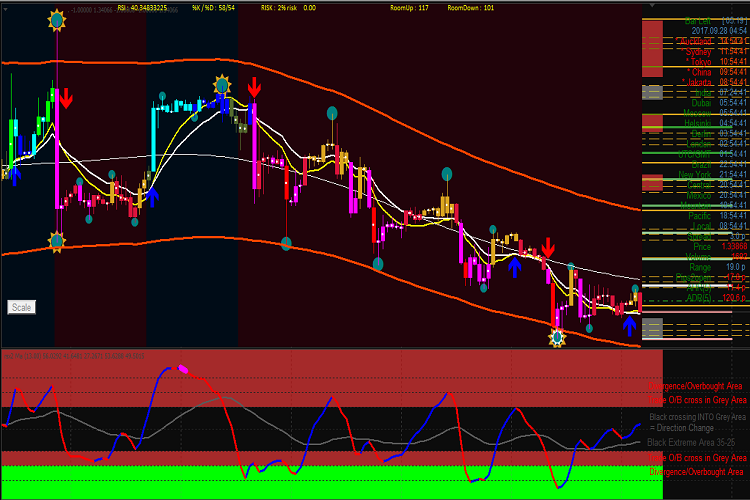

In this section, price fluctuations usually happen in either an upwards or downwards direction. A sloping trend is maintained here. You can call it to trend surely, but a short-time trading possibility occurs in this channel. Being an active trader in the options market, you should be extremely cautious about the diagonal range since most of the major breakout take place right after this phase.

Continuation range

The continuation range can occurs any time. False breakouts are expected in this type of market movement. Since it moves very fast, traders who want to run their action quickly can earn profit. It shows quick breakouts and it can also takes place in the middle of any patterns. Though it occurs during other ongoing trends, you can easily deal with the continuation range by using the candlestick pattern trading technique.

Irregular range

It is possible to transform a diagonal ranging into a rectangular one. It creates new support and resistance lines. It is difficult to identify the support and resistance line here, but those who have a more fantastic experience can predict the movement. The follower of this may need to use some extra tools to be sure of the potential breakouts.

There is no limit to experiencing this market condition. Active investors need to understand the strategy and the pros and cons of ranging. Then it will be effective for them.

Identify

It should be a significant priority to identify a range first. If a specific currency recovers from a support position ( a minimum of twice), it can be accepted. It should also be pulled back from the resistance area (again, at least twice).

Manage risk

After joining the area, you need to think about risk management. Undoubtedly risk management is the most crucial factor in trading. Get ready to take a step when a support or resistance level breaks. Setting a stop loss will help you to ensure you have good risk management. When you enter in a ranging market, your efforts will be the most critical factor if your additional concerns remain in the right place.

Trending and Ranging currencies

Here are 4 major currency pairs used the most in trading.

- EUR/USD

- USD/JPY

- GBP/USD

- USD/CHF

The most significant pair, EUR/USD, is mainly used for trading. The value in terms of transactions is almost $1 trillion per day.

Trend

If the line of fluctuation is going high, an uptrend begins, and when it is coming low, a downtrend happens. If the course of the trend is predicted correctly, you can make big money By using the leverage smartly, it is pretty easy to enjoy an outstanding achievement.

Above, we have read about four types of ranges. All those have different psychoanalyses. Do not mix them up. Some do look like a trend, but in reality, they are not exactly as they seem. No matter which direction the currency goes in (up or down), it will come back to its origin. It is safe to move forward with ranging. In most cases, it requires a different money-management technique.